Liquid Gold: Inside the Booming World of High-End Spirits Auctions

Collectors are snatching up Super-Aged Status Spirits at increasingly obscene prices. Maxim investigates if the investment is worth it, what to look out for and of course what’s next.

“This beautiful level of whiskies play a hugely important role, because what they’re doing is bringing depth to the category, as well as intrigue and desirability. At this top level what you’re playing with is rarity and uniqueness,” posits Gordon & MacPhail’s Stephen Rankin from his home in northeast Scotland.

“In the same way as limited edition Ferraris or Bugattis— why does one need to exist? You can’t drive it on the open road, it goes too fast. But like a car the difference with this whiskey, as opposed to coins or whatever other stock investment, is it is something you can experience, you can drink it.”

As Director of Prestige at the esteemed family-owned whisky label it is literally Rankin’s job to guide the growth and release of their treasured casks.

Founded on Elgin’s South Street in 1895 as an elevated shop for luxury goods, Gordon & MacPhail soon started buying whisky from nearby distilleries, casking it themselves in ex-Sherry and bourbon American oak and meticulously shepherding the aging process. They were the first to offer single estate, or single malt, bottles, and even today still only sell whisky which they’ve aged completely themselves.

“Can you imagine the sense of pride where you’re bottling something your uncle, or grandfather, was responsible for pulling apart and laying that cask down?” he asks between sips of Mr George Centenary Edition 1956.

Poured into in a hand-selected Sherry Butt by Rankin’s grandfather George Urquhart in 1956, the 62-year-old single malt from the Glen Grant distillery was bottled in 2019 to celebrate Urquhart — a scotch legend considered instrumental to the current success of single malt. “What a whisky,” smiles Rankin. “I wasn’t even a twinkle in my parent’s eyes when this was casked!”

Recent G&M offerings like a 72-Year-Old Glen Grant distilled in 1948 went up for auction at the beginning of the year with a book estimate between $38,700 and $49,000. One of the latest in their ultra-rare Private Collection is a Caol Ila from 1968, the oldest whisky ever from this renown distillery predating its rebuild in the early-70’s; Rankin claims the 50-Year-Old is one of the finest Islay Whiskies he has ever tasted. Bottlings like Gordon & MacPhail’s Private Collection are selected solely by family members, meaning a cask is only released when they all agree it’s finally ready.

“It’s an incredible honor to work with such liquid. Imagine sitting on the shoulder of Leonardo DaVinci while he paints the Mona Lisa and then saying to people decades later, Oh I saw him paint that!” muses the Director of Prestige. “It does feel that we’re often exploring very much uncharted waters with a lot of these releases, because nobody’s ever done something with this age before.”

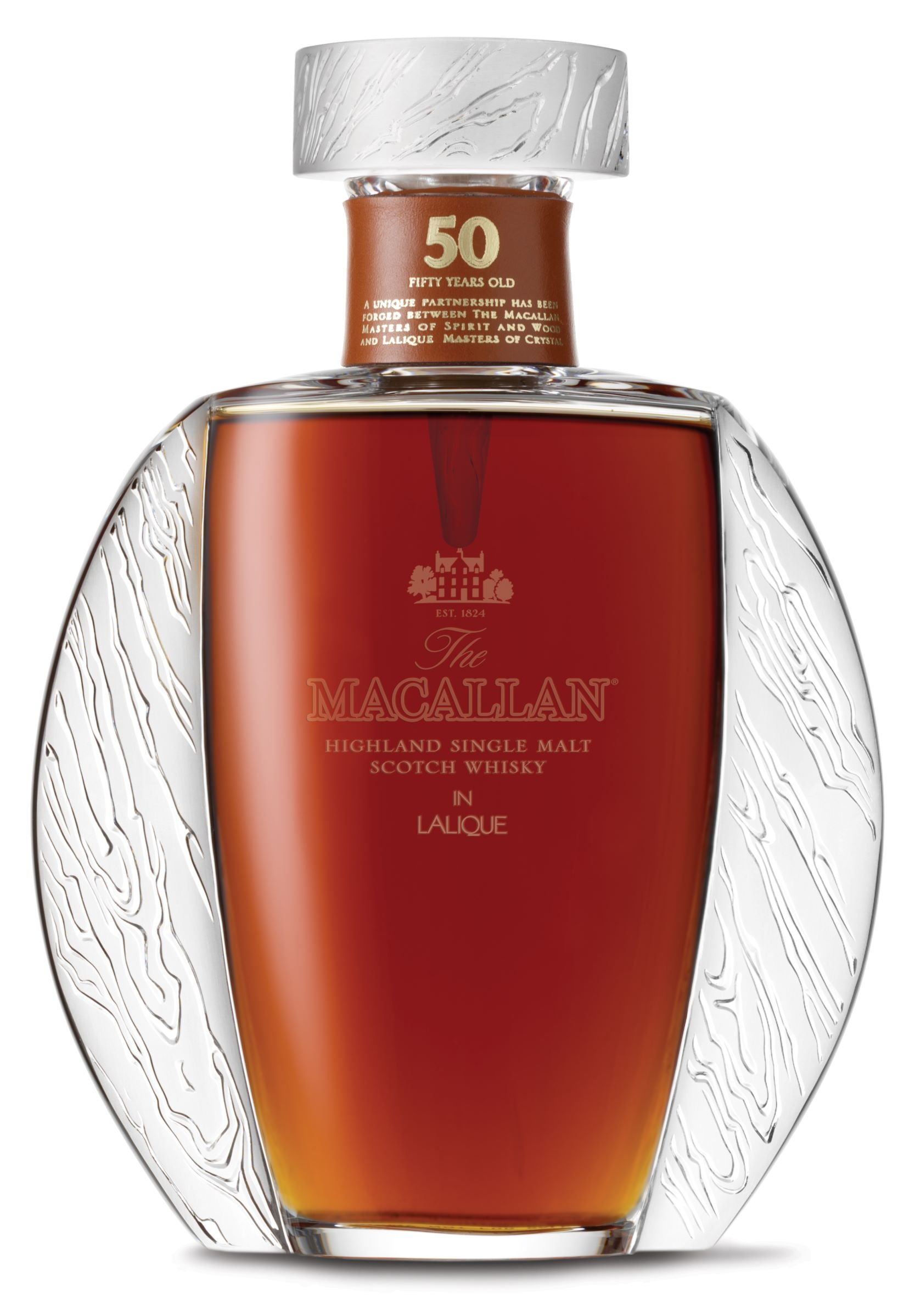

To see just how much the market has shifted this century, consider The Macallan’s 1949 Millennium Decanter 50-Year-Old. When released just 20 years ago the bottle’s $2,800 (£2,000) pricetag raised eyebrows — not just from casual fans who found the price exorbitant but also from collectors.

It was a statement single malt, one of the highest-ever rated by whisky connoisseur Michael Jackson, and yet it sat in shops as investors balked at the cost. Barely more than two decades later it regularly fetches north of $80,000 when the rare bottle hits the auction block.

“The difference is before in scotch you only had the big boys doing these serious super-aged limited edition whiskeys. Now every distillery in Scotland are all launching 40-, 50-year-old whiskeys and charging some serious prices,” notes Sukhinder Singh, co-owner and founder of The Whisky Exchange — a leading global retailer of fine spirits, with an award-winning online shop and a flagship storefront in Covent Garden, London. “And they’re all selling,” he continues, “which means the demand is there.”

Singh points out how small distilleries like Glengoyne, Tamdhu, and Loch Lomond have all launched 50-year-old expressions within the last couple years, while cult Islay distilleries like Ardbeg, Laphroaig, Lagavulin and Bowmore boast fanatical followers. Clynelish in particular is becoming ever more difficult to find because it’s a key single malt ingredient of Johnny Walker, which hordes all the juice they can grab.

Singh states prices for the 25-Year-Old have literally doubled in just the last two years, and recalls how his store recently bottled 150 of the Northern Highland distillery’s 21-Year Old for £200 apiece. “It sold out in I think three or four minutes,” he reveals. “And I can guarantee you next month one of these bottles will be at auction and it’ll reach £400, so double within weeks.”

Not simply a merchant, Singh has become one of the world’s most respected collectors by sourcing old and rare whiskies, gathering since the late 1980s what is considered one of the most important private compendia of single malts anywhere. His vaults boast more than 10,000 bottles, with 2,000 of those earmarked for his “drinking collection.” As a collector Singh strongly suggests if you can afford it buy two of your most coveted expressions: one to keep, the other to share with friends.

As the number one valued auction whisky in the world The Macallan is widely seen as leading this charge. In February they unveiled a stunning collection of 1967 whisky dubbed the Anecdote of Ages Collection.

Each of the 13 bottles feature a one-off original artwork label signed by knighted pop collage artist Sir Peter Blake, best known for his iconic Beatles Sgt. Pepper’s Lonely Hearts Club Band album cover. What will each of these bottles fetch, one wonders? The Macallan is selling 322 bottles that mirror Bottle #13, and each of those is retailing at $83,000. The sky is the limit for the original 13.

“Having the opportunity to collaborate with such esteemed artists such as Sir Peter Blake has been incredibly fulfilling, and has led to truly impeccable liquid releases,” Sarah Burgess, Lead Whisky Maker at The Macallan, tells us. “It has been humbling to see our craftsmanship recognized in whisky auctions around the world,” she admits, and then shifts gears. “While we recognize that some consumers take joy in collecting our releases, we ultimately produce our whisky to be enjoyed.”

When asked if things have gotten out of control, Singh laughs. “I don’t want to get into trouble! Look, the thing is, if the bottles sell at the end of the day and they achieve record prices, then who am I to argue?” Of course it’s not just The Macallan going the extra mile to create singular packaging that moves markets.

American bourbon makers Woodford Reserve recently poured some honey barrels in decanters made by a renown French crystal house, selling their aptly named Baccarat Edition for $2,000. The Balvenie boxes its Marriage 50-Year-Old bottle in a wooden cylinder handcrafted by furniture designer Sam Chinnery using forty-nine layers of Banffshire Elm and Lothian Walnut culled from their own forests — you know, for extra terroir.

“You see what luxury brands are doing trying to go far and wide in terms of new target audiences, hence art, photography, furniture,” notes Singh. “Look, it works. For me I always say The most important thing is the liquid. I don’t care about packaging, I actually don’t care about anything apart from the liquid.”

When asked what are some liquids that recently moved his needle, Singh is quick to mention Black Bowmore DB5 1964, a collaboration with Aston Martin celebrating the DB5’s on-screen debut as James Bond’s iconic ride in Goldfinger. “I’m a big Bowmore collector,” notes the Sikh entrepreneur. “I think Bowmore whiskies distilled in the 1960’s are some of the finest ever made.”

Another expression whose packaging could raise eyebrows, what with its handmade presentation box and bottle handcrafted by Scottish glass studio Glasstorm, Bowmore DB5 1964 is evidence that more often than not you actually can judge an ancient whisky by its handblown Lalique crystal cover.

“The liquid has to be good. If no one is drinking them because they’ve all heard it’s not that good and they just plan to resell it, then it doesn’t really work,” explains Whisky Auction’s private client and auction director Isabel Graham-Yooll. “It has to be special enough to be consumed, and in general the truth is these bottles are because it’s too much of a risk to release something at astonishing prices for someone to open it up and say, Oh, actually it’s not as good as I thought it would be! The quality has to match.”

Of course there are many forces far more important than fancy decanters driving prices skyward, among them rock bottom international interest rates and volatile stock markets. They make ancient whiskies a far safer investment to park your money, as whiskey has outperformed the S&P 500, gold bullion and cryptocurrency in the past decade.

The proliferation of online auction houses has also increased access — some point to the inaugural Scotch Whisky Auction in 2011 as landmark. But without question the most powerful force in this category’s uptick is the explosion of demand from the Asian continent. And while largely driven by China’s thirst for single malts, other torrid Eastern markets like Hong Kong, South Korea, Vietnam, Taiwan, India and Singapore all increase pressure.

“The U.S. is important, Europe is important, but we all know in honesty the people who spend a lot of big money for both collecting and drinking are Asians. They just do. It’s part of their culture, they love gifting, they enjoy drinking,” Singh observes, and then pauses. “I’ve got dozens of friends now there who, what they open on a weekly basis is quite mind blowing. I am sometimes very envious.”

Of course with any over-heating market comes trepidation, anxiety, and whispers of a bubble. When previously unconsidered commodities are suddenly marked as “collectible” then capitalists will scheme.

Everything from comic books to Beanie Babies to baseball cards to Internet Bubble 1.0 experienced rabid growth, all to be killed by greedy marketers who game the system and crash the market. So if every distillery in the world is putting out single casks, rare ultra-aged expressions and distillery exclusive bottlings could this market overheat and potentially pop?

“I would say probably not at the moment, simply because of demand and supply,” argues Singh. “I think fortunately very few brand owners are capitalizing on the fact that it’s purely for collecting — hopefully most of them are doing it for the liquid. So as long as the demand is there and the whiskey is good, people will drink it.”

Scarcity vs demand, desirability, quality and ‘intrigue’/passion are all key factors in whisky’s financial resilience explains Andy Simpson, a market analyst and co-founding director of Rare Whisky 101. “The small volumes of collectable bottles in the market, compared to wine as a good example, means acquiring ‘meaningful’ bottles is becoming harder every year. Couple that with global increasing demand for rare/old bottles of scotch and it’s almost a perfect-storm-asset-class.”

Having followed whisky prices for over 20 years, Simpson established RW101 in 2014 and closely tracks the market with indexes like their Apex 1000, RW101’s broadest Single Malt Scotch measurement. “Whisky is also a single-use asset: cars can be driven every day, paintings are looked at for eternity, watches are worn as prized possessions time and time again — but open a bottle of whisky once and its value is in the memories it creates rather than sunk into the asset.”

While scotch has seen the most vertiginous growth, other categories are starting to realize their values climb as well. Just across the North Channel from Islay lies the country that invented whiskey in the 14th century, and interest in its rare gems like Knappogue Castle 1951 have seen “significant growth over the past few years,” shares Brand Director Jon Dubin, “and I am very optimistic about the future of the category.”

First made available in 1998, Knappogue Castle sells a bottle of its treasured 1951 for about $2,100, which comes simply packaged in the original glass. “With the double digit growth of scotch single malts there’s a huge opportunity for the Irish Whisky category to capture some of that market share,” says Dubin.

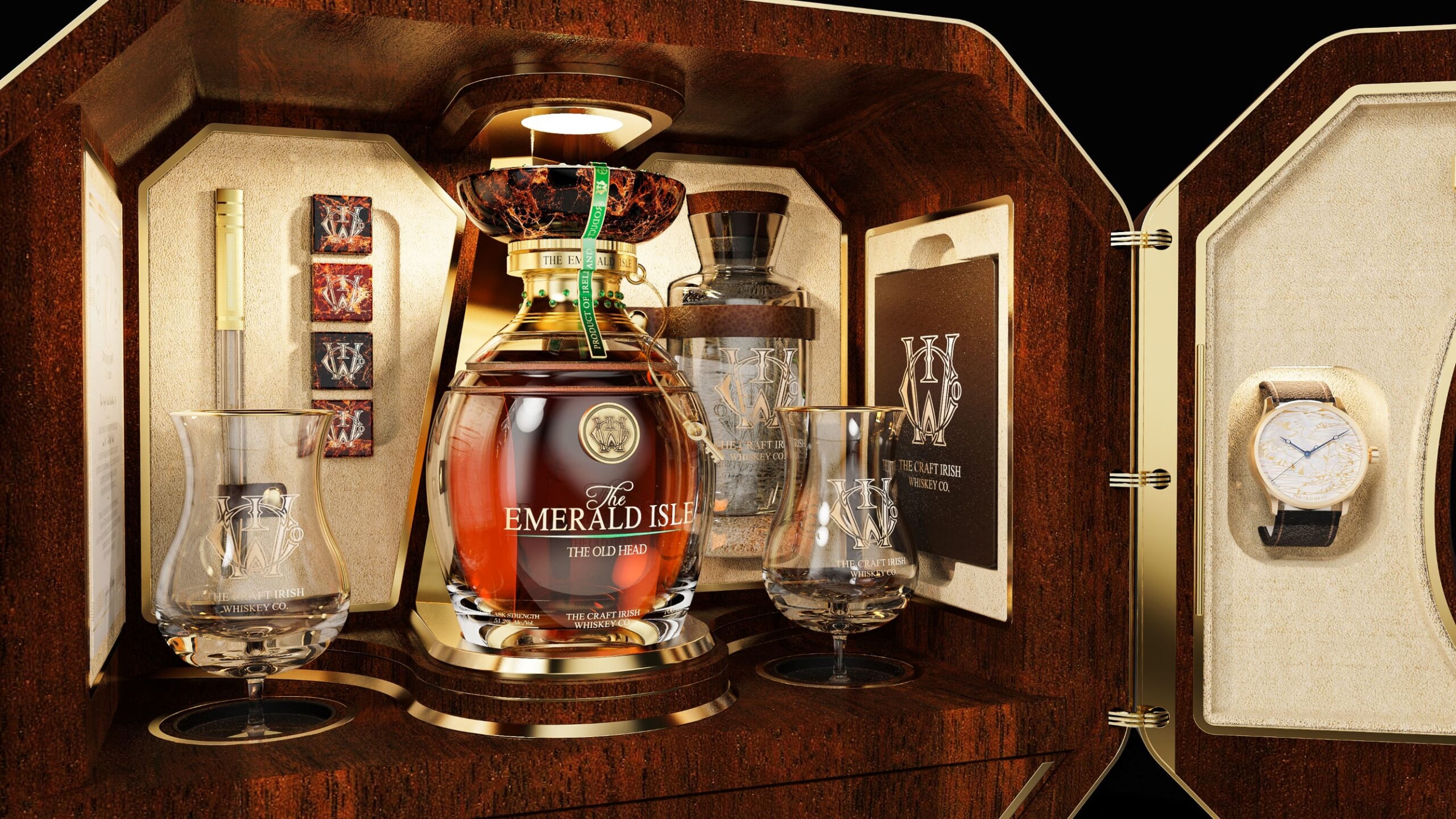

Taking a far more precious approach with its juice is the nascent Craft Irish Whiskey Co., whose only second release ‘The Emerald Isle Collection’ snatches the crown as the oldest triple-distilled Irish whiskey in the world. Made in collaboration with celebrated Russian jewelers Fabergé, all seven of its bespoke ‘Experience Boxes’ will be sold exclusively via private auction.

The dark walnut boxes come replete with a Celtic Fabergé egg, bespoke one-of-a-kind Fabergé Altruist 18k rose gold timepiece, a rough, uncut Zambian emerald presented on a gold guilloché-enameled claw-foot base and a humidor with two rare Cohiba Siglo VI Gran Reserva cigars (with gold-plated cigar cutter, naturally). The munificent chests also boast a flask, a gold-plated water pipette, obsidian stones and a carafe filled with authentic Irish spring water. Oh, and two bottles of 30-year-old triple-distilled juice which CIWC claim to be “the rarest Irish whiskey in existence.” The auction held in Texas on February 2, 2021 started at $2-million.

Outside of whisky, the categories experts look at to experience the most growth in this auction level are Cognacs and Armagnacs. The reason for this is twofold: 1. Scarcity, as especially Armagnac is mostly made by small, rustic producers; and 2. Aging, as both Cognac’s and Armagnac’s complexities only increase the older they stay in the barrel. Compare this to spirits like bourbon and rum which not only see huge angel’s share losses but are spirits which many experts see peaking after 10-20 years of aging.

But even these French spirits have a ways to catch up — which also means either are a fantastic place to potentially start your investment portfolio. At a Whisky Auction event in February a Domaine de la Vie cognac from 1777 sold for $56,000 (£40,500), making it amongst the most expensive Cognacs in the world.

But for a liquid that dates back to the American Revolution, nearly a quarter of a millennium ago, that price sounds, well, reasonable compared to single malts. Other bottles in the sale included an 1802 vintage for $20,000 (£14,400) and a 1906 for $6,500 (£4,700).

“Over the past year luxury spirits have experienced unprecedented demand, and cognac is no exception,” explains D’USSÉ Cellar Master Michel Casavecchia, highlighting that not only is cognac the fastest growing spirit (sales up 62% from 2019 to 2020), but his D’USSÉ label is the fastest growing brand in the category.

Recently the label, which belongs to the Château de Cognac house, released a 1969 Anniversaire Limited-Edition poured into a 12-cut crystal diamond decanter, complete with 24-karat gold foil and signed by D’USSÉ co-founder Jay-Z. “Bottle No. 1” was auctioned at Sotheby’s for between $25-75K.

Casavecchia believes lack of awareness is partly responsible for cognac’s slower uptake, but that’s changing quickly. “We see single malts at auctions all the time — auctioning a fine scotch is nearly as common as fine art or cars — so they have the reputation as a spirit high in value.” As a craft product with extremely limited production, he notes cognac makes up less than 1% of the world’s spirits by volume; it simply doesn’t have the same recognition as other more mainstream options.

One embryonic label looking to leverage the apparent undervaluation of Armagnac is Bhakta 50. Their first expression is a thing of exquisite treasure, blending eight ultra-rare Armagnac vintages — the oldest, from 1868, predates the incandescent light bulb. Even the youngest vintage, from 1970, is more than half a century in the making.

After marrying and finishing in Islay whisky casks the ancient Armagnac is poured into a stylish art nouveau bottle and sold for $250 — a seemingly reasonable price to tap a liquid of this age. “The oldest spirits have always been and will likely always be the most valuable,” offers founder Raj Bhakta. “We all love the idea of drinking something that has waited lifetimes to touch our lips. When you get it right, there is no replacement for age.”

Something Stephen Rankin of Gordon & MacPhail said early in our conversation comes back to mind, and embodies in essence the soul of this endless quest.

“We all put our best science and our best endeavors into it from day one, with the hope we’ve judged the destiny of that potential cask just right. But of course that cask is made out of oak which has been made by Mother Nature and every one is slightly different. Some of them are ready at 15-years-old, some are ready at 30-years-old, and some of those whiskies are best at 70-years-old,” he considered thoughtfully between sips from his amber Glencairn glass.

“Yes this category is a genuine investment platform today. But these bottles are also incredible, and those who are lucky enough to be able to drink them can put themselves as one of the few people in the world who have.”